Paddy Power online casino has introduced to UK punters Paddy Power Cash Card PPlus as well as Paddy Power Cash Card.

Paddy Power online casino thought of helping the gamers at their site and offered them convenient method to deposit and withdraw the real cash instantly into Paddy Power account to play casino games or do sports betting.

Paddy Power Cash Card PP Plus

The Paddy Power Cash Card PPlus is a pre-paid card that is linked to your online betting account and allows instant access to your online funds. So whatever the balance is in your online Paddy Power account is the balance available on your Cash Card PPlus.

You can use your card in any Paddy Power high-street shop to check your online balance, make a deposit or withdraw. This means you’ll be able to bet without ever having to use your bank card and thus, no transactional data will appear on your bank or credit card statements.

It also important to note that with the Cash Card PPlus, you cannot run up any form of debt. If you attempt to make a payment that is greater than the available funds in your online Paddy Power account then your request will be declined.

The Cash Card PPlus is completely free for all Paddy Power players and there are no hidden costs when using it.

What you can do with Paddy Power Cash Card PP Plus?

- ATM Usage – Withdraw cash using your online funds at any ATM that accepts Mastercard

- Contactless – Utilise the cards contactless technology to make quick and easy transactions.

- Chip & Pin – Make payments with the chip and pin machine.

- Online Purchases – Make online payments and purchases using your online Paddy Power balance.

- No Bank History – Withdraw funds without any transactional data appearing on your bank/card statements.

The difference between Cash Card and Cash Card PPlus is that Paddy Power Cash Card PPlus is a prepaid MasterCard linked to your PaddyPower balance and PaddyPower Cash Card allows you to deposit and withdraw money in Paddy Power shops.

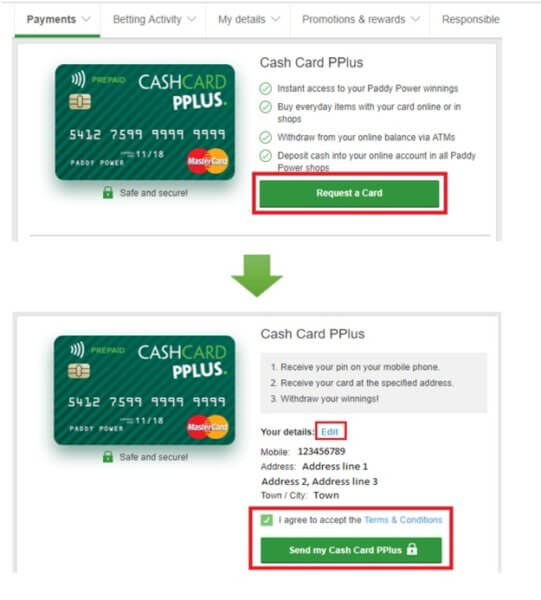

How to get Paddy Power Cash Card PP Plus?

Here’s how to get a Paddy Power Cash Card PPlus:

- Log-in to www.paddypower.com.

- On the Paddy Power home page, navigate to the ‘My Account’ page from the option located in the upper right corner and select ‘My Account’ from the drop down

- Highlight the ‘Payments’ header from the top navigation bar to open the drop down menu

- Select ‘Cash Card & PPlus’ from the drop down menu

- Click on ‘Request a Card’ from the Cash Card PPlus option, then tick the box to accept the T&Cs and click ‘Send my Cash Card PPlus’ button to complete the process

- If you need to update your details such as your phone number or address, you can click the ‘Edit’ button to amend this information before completing your request

- You will then receive your card within 14 days.

- Activate your Cash Card PPlus online in the ‘My Account‘ section and you’re good to go.

Like any other debit card, there are limits to how much you can use the Cash Card PPlus. Below are the details:

| Details | Amount |

| Max annual spend limit per account | €15,000/£10,000 |

| Max single transaction value per card | €500/£350 |

| Max daily spend limit per account | €2,500/£1,666 |

| Max number POS transactions allowed per day | 10 |

| Max number POS transactions allowed per 4 days | 40 |

| Max value POS transactions allowed per day | €2,500/£1,666 |

| Max value POS transactions allowed per 4 days | €10,000/£6,666 |

| Max number ATM withdrawals per day | 2 |

| Max number ATM withdrawals per 4 days | 8 |

| Max value ATM withdrawals per day | €600/£400 |

| Max value ATM withdrawals per 4 days | €2,400/£1,600 |

Deposits and Withdrawal limits

The minimum deposit is €10 and maximum deposit is €2500 which is done instantly.

You can deposit cash to your online account in any of Paddy shops across UK and the UK as follows:

Bring your cash to the desk and quote your username or account number to the cashier. They will process your deposit and the funds will be in your account straight away.

If you have lost or misplaced your Cash Card, you can get a new one from any of Paddy Power shops for free and then contact Customer Services, who will link the new card to your account.

Withdrawal:

The minimum withdrawal is €1 and maximum withdrawal limit is €1000. You get your wins immediately

To withdraw your winnings or cash from your Account:

| Step 1. | Go to one of Paddy Power shops in the UK and UK. |

| Step 2. | Scan your Cash Card on a betting machine. |

| Step 3. | Click on Withdraw. |

| Step 4. | Print a ticket from betting machine and collect your cash at the counter. |

If you notice a difference between online balance and withdrawable balance:

- Sometimes Paddy Power have restrictions on what you can withdraw due to free bets the casino gave you, a recent deposit or in the case of gaming machines because you have credit card funds in your account.

- They have daily limits on cash transactions which are €/£2,500 deposit. €/£ 1,000 withdrawal. These are 24 hour limits.

- If you have lost or misplaced your Cash Card, you can get a new one from any of Paddy Power shops for free and then contact Customer Services, who will link the new card to your account.

Note that your withdrawal value will appear under the description ‘PP Online’ on your bank statement

Other deposit options at Paddy Power UK Casino

Following are the other deposit options at Paddy Power UK Casino:

- APMs/E-Wallets

- Bank Transfer Deposit

- Neteller

- PayPal

- PaySafeCard

- Skrill/Moneybookers

- Rapid Transfer

The minimum deposit is € 5 to € 10

Then there are Net deposits. Net Deposits are the difference between the Total Deposits and Total Withdrawals you’ve made for a particular payment method – such as a debit or credit card. The Net Deposit figure is worked out simply by taking the Total Withdrawals amount from the Total Deposits amount.

If you have deposited more than you have withdrawn to a payment source you will have positive Net Deposits.

If you have withdrawn more than you have deposited to a payment source you will have negative Net Deposits.

Example: Total Deposits of £3,050 minus Total Withdrawals of £3,000 equals Net Deposits of £50. This is a positive Net Deposit figure.

Each payment method you use on your account will have a separate Net Deposit figure. If you’ve got more than one payment method registered with positive Net Deposits it will impact how you can withdraw your funds.

How long does it take for a withdrawal transfer to show in your bank account?

- All UK GBP Bank Transfer Withdrawals made before 10.30am will reach your Bank account that Same Day, otherwise the funds will reach your bank account Next day.

- All SEPA EURO Bank Transfer Withdrawals made before 10.30am will be processed as ‘Next Day’ and will reach your bank account the Next day. Otherwise it will take 2 days.

- All International Bank Transfer Withdrawals will take 3-5 days to reach the customers bank account.